内网登录

内网登录 “约束式注浆工艺技术”在基坑新工艺项目中全面推广应用

欧冠竞猜平台-腾讯体育推广实施的基坑新工艺自稳式基坑支护结构技术,因其显著的优点,近几年应用的项目越来越多。为使得该技术能更广泛的使用,我司技术团队聚焦产品升级、不断...

“约束式注浆工艺技术”在基坑新工艺项目中全面推广应用

欧冠竞猜平台-腾讯体育推广实施的基坑新工艺自稳式基坑支护结构技术,因其显著的优点,近几年应用的项目越来越多。为使得该技术能更广泛的使用,我司技术团队聚焦产品升级、不断...

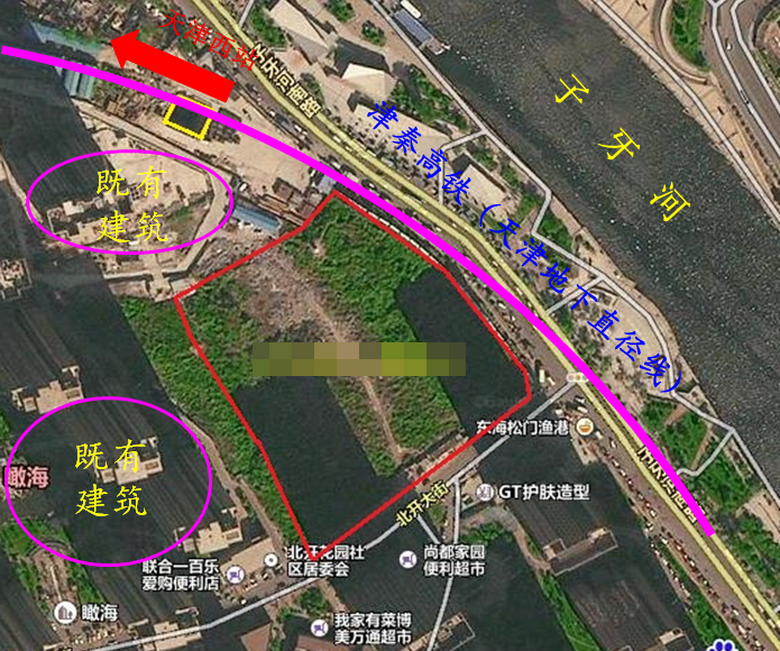

地下水自动回灌技术在高铁隧道保护工程中的应用案例——天津某项目

该项目包括11栋25~33层住宅楼,最大高度99.98m;2栋1~2层经营性商业用房;整体地下车库。工程共分为三期,其中工程一期地下车库为1层,埋深为6.00m,工程二期和工程三期地下车库为...

地下水自动回灌技术在高铁隧道保护工程中的应用案例——天津某项目

该项目包括11栋25~33层住宅楼,最大高度99.98m;2栋1~2层经营性商业用房;整体地下车库。工程共分为三期,其中工程一期地下车库为1层,埋深为6.00m,工程二期和工程三期地下车库为...

新工艺绿色高效能可回收基坑支护组合技术应用案例——上海某项目

该项目位于上海市奉贤区,基坑开挖面积大,超过30000平方米。普遍开挖深度5米,局部开挖深度8米。周边环境较复杂,基坑环境保护等级局部为二级,基坑边线距离用地红线较近,一...

新工艺绿色高效能可回收基坑支护组合技术应用案例——上海某项目

该项目位于上海市奉贤区,基坑开挖面积大,超过30000平方米。普遍开挖深度5米,局部开挖深度8米。周边环境较复杂,基坑环境保护等级局部为二级,基坑边线距离用地红线较近,一...

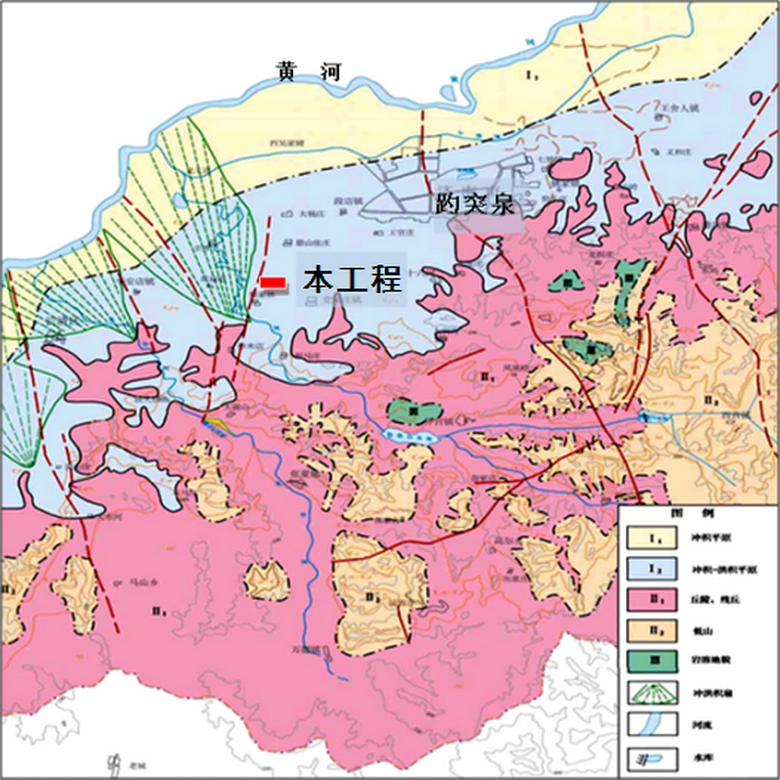

地下水加压回灌在富水地层的应用案例——济南某项目

济南市位于东经116 54'~117 02',北纬36 35'~36 40'之间,南依泰山,北临黄河,水文地质条件特殊,是著名的 泉城 。地下水的保护在以 泉 闻名的济南市显得尤...

地下水加压回灌在富水地层的应用案例——济南某项目

济南市位于东经116 54'~117 02',北纬36 35'~36 40'之间,南依泰山,北临黄河,水文地质条件特殊,是著名的 泉城 。地下水的保护在以 泉 闻名的济南市显得尤...

厂房结构改造加固案例——上海某项目

上海某厂房结构改造加固工程具有工期紧、施工工艺复杂、安全隐患多等难点,涉及的施工工艺包含结构切割、碳纤维布加固、包钢加固、增大混凝土截面、新增混凝土构件等。公司在该项目...

厂房结构改造加固案例——上海某项目

上海某厂房结构改造加固工程具有工期紧、施工工艺复杂、安全隐患多等难点,涉及的施工工艺包含结构切割、碳纤维布加固、包钢加固、增大混凝土截面、新增混凝土构件等。公司在该项目...

新视角记录千年古刹太平报恩寺重建

长凯岩土于2016年7月承接了千年古刹太平报恩寺重建项目的基坑降水工程。太平报恩寺位于上海市杨浦区兰州路373号,原名“太平教寺”。始建于北宋太平兴国年间,为杨浦区境内最早的佛...

新视角记录千年古刹太平报恩寺重建

长凯岩土于2016年7月承接了千年古刹太平报恩寺重建项目的基坑降水工程。太平报恩寺位于上海市杨浦区兰州路373号,原名“太平教寺”。始建于北宋太平兴国年间,为杨浦区境内最早的佛...